Nebraska Homestead Exemption

The Nebraska homestead exemption program was designed by the state to provide property tax relief. This program is available to homeowners who meet specific requirements.

In this article:

What Is the Homestead Exemption Program?

Under the Nebraska homestead exemption program, qualifying homeowners will see a decrease in their property taxes. When homeowners are approved for an exemption, the State of Nebraska will reimburse the homeowners' counties for the reduction in tax revenue.

The exact amount of each homeowner's property tax reduction depends on several factors, including the homeowner's category, income and homestead value. For this reason, the amount of your homestead exemption may change over time.

Who Can Qualify?

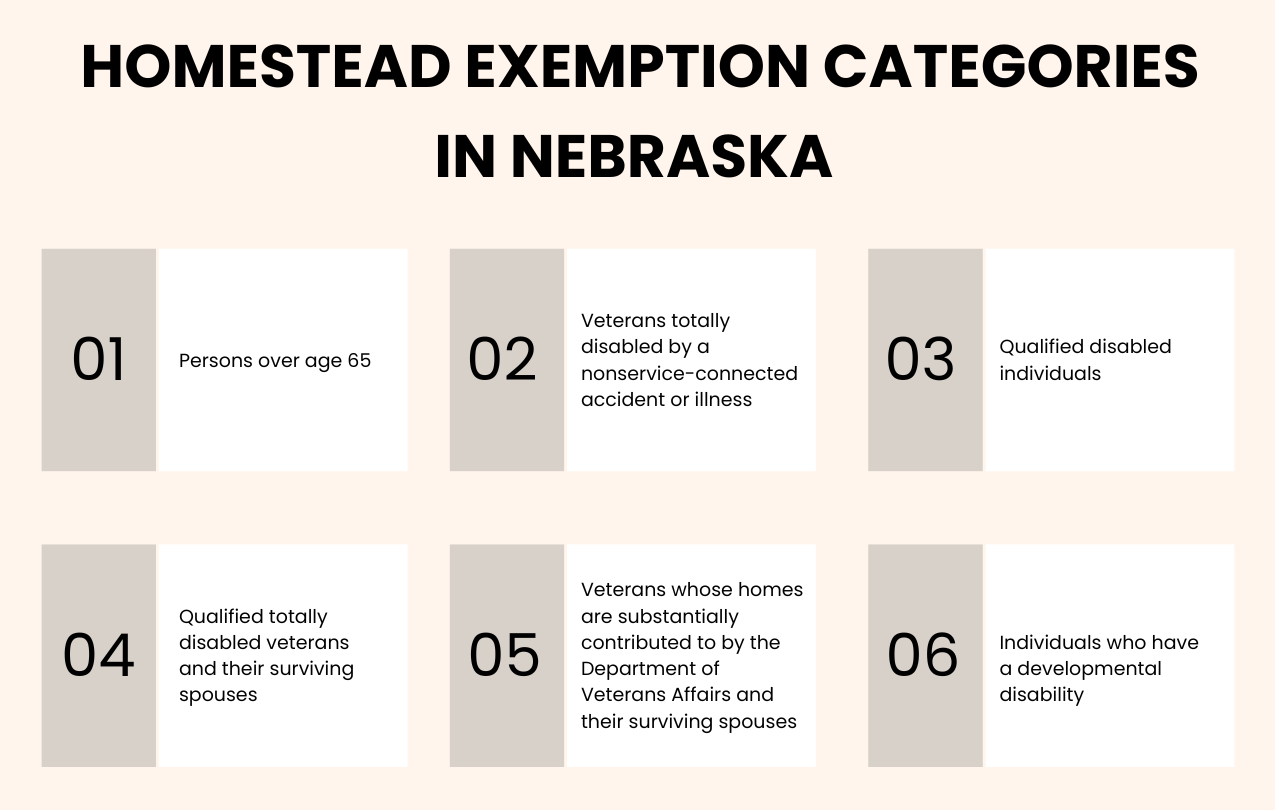

Nebraska offers its homestead exemption program to six different categories of homeowners:

- People over the age of 65

- Veterans who have been totally disabled by nonservice-connected illnesses or accidents

- Disabled individuals

- Totally disabled veterans and spouses of deceased totally disabled veterans

- Veterans and spouses of deceased veterans who have received substantial housing assistance from the Department of Veteran Affairs

- Individuals with a developmental disability

All categories are subject to the basic requirements of ownership and occupancy. Most of these categories also come with homestead value requirements and income limits. However, there are no such requirements or limits for homeowners that fall into category 4 or 5.

Basic Qualification Requirements

Ownership and Occupancy

Regardless of your category, you must meet the requirement of ownership and occupancy. This means that you must have owned and occupied your home from at least January 1 to August 15.

Filing Form 458

All categories of homeowners applying for a homestead exemption must also file Form 458. This form must be completed and submitted on an annual basis in order to qualify for the exemption.

Schedule I

With the exception of homeowners who fall into Category 4 (totally disabled veterans and spouses of deceased totally disabled veterans) and Category 5 (Veterans and spouses of deceased veterans who have received substantial housing assistance from the Department of Veteran Affairs), all categories of homeowners must also file Schedule I.

Other Requirements

Specific categories of homeowners are also subject to other requirements. To determine which specific requirements will apply in your case, consult the information below as it relates to your category.

Qualification Requirements by Category:

Category 1

People over the age of 65

To qualify for a Nebraska homestead exemption under this category, you must:

- Be at least 65 years old before January 1 of the application year.

- Own and occupy the home in question from at least January 1 to August 15.

- Meet income requirements.

The income requirements depend on whether you are single or married. Your qualifying income will also be used to determine the amount of your exemption. The lower your qualifying income, the greater your exemption will be.

It is also important to note that your exempt amount may be reduced if the assessed value of your homestead exceeds a certain limit. The amount by which your homestead's assessed value exceeds the maximum will determine how significant this reduction will be.

Category 2

Veterans who have been totally disabled by nonservice-connected illnesses or accidents

To qualify for a homestead exemption under this category, you must:

- Be a wartime veteran who became totally disabled as the result of an accident or illness not connected to service.

- Own and occupy the home in question from at least January 1 to August 15.

- Include Form 458B or a certification of disability from the DVA with your first filing.

- Meet income requirements.

As with Category 1, the income requirements depend on whether you are single or married. Your qualifying income will also be used to determine the amount of your exemption. The lower your qualifying income, the greater your exemption will be.

Likewise, your exempt amount may be reduced if the assessed value of your homestead exceeds a certain limit. The amount by which your homestead's assessed value exceeds the maximum will determine how significant this reduction will be.

Category 3/Category 6

Disabled individuals/Individuals with a developmental disability

To receive a homestead exemption under either of these categories, you must:

- Have a qualifying disability.

- Own and occupy the home in question from at least January 1 to August 15.

- Include Form 458B with the first filing.

- Meet income requirements.

As with other categories subject to income requirements, the specific income requirements depend on whether you are single or married. Your qualifying income will also be used to determine the amount of your exemption. The lower your qualifying income, the greater your exemption will be.

Likewise, your exempt amount may be reduced if the assessed value of your homestead exceeds a certain limit. The amount by which your homestead's assessed value exceeds the maximum will determine how significant this reduction will be.

Category 4/Category 5

Totally disabled veterans and spouses of deceased totally disabled veterans/Veterans and spouses of deceased veterans who have received substantial housing assistance from the Department of Veteran Affairs

To qualify for a homestead exemption under this category, you must:

- Be a totally disabled veteran who receives compensation from the Department of Veteran Affairs for a service-connected disability OR a veteran whose home has been substantially contributed to by the DVA OR the widow/widower of someone who met one of these requirements.

- Own and occupy the home in question from at least January 1 to August 15.

- Include a certification from the DVA with your first filing.

There are no income requirements or maximum assessed value reductions under these categories.

Filing the Paperwork

All categories of homeowners applying for a homestead exemption in Nebraska must file Form 458 on an annual basis. This form is due between February 1 and June 30 of each tax year and must be submitted to your county assessor. Depending on your category and whether or not it is your first filing year, you may need to submit other forms as well. All of the forms you need can be found on the Official Nebraska Government Website.

Special Information for Douglas County

Applicants who have filed for homestead exemptions in Douglas County in the past should receive an application by mail each year. New applicants can get an application by visiting the Douglas County Assessor's office in person or by calling and requesting that a form be sent by mail.

Completed applications in Douglas County can be mailed, emailed or dropped in the box outside the assessor's office. Contact information for the assessor's office in Douglas County is as follows:

Assessor/Register of Deeds, Homestead Exemption, 4th Floor

Omaha, NE 68183

Phone: 402-444-7060

Email

Special Information for Sarpy County

Sarpy County mails applications to homeowners who have received a homestead exemption in previous years. If you do not receive an application by mail or if you are a new filer, you may access the application on the Official Nebraska Government Website. Completed applications in Sarpy County can be emailed, mailed, faxed or dropped off at the assessor's office using the following contact information:

Sarpy County Assessor's Office

1210 Golden Gate Drive

Papillion, NE 68046-2923

Phone: (402)593-2122

Fax: (402)593-5911

Email