The White House recently announced additional measures to help struggling homeowners avoid foreclosure as they exit forbearance, including loan modifications and payment reductions. Borrowers with federally backed mortgages can lock in lower interest rates and extend the length of their mortgages. For borrowers who can’t resume their monthly mortgage, HUD will offer lenders the ability to provide all eligible borrowers with a 25% principal and interest reduction.

The National Association of REALTORS® reported inventory of homes for sale nationwide rose slightly in June as more sellers list their homes, hoping to take advantage of record-high sales prices across the country. Even with renewed home seller interest, inventory overall remains 18.8% lower than a year ago, according to NAR.

The Bottom line:

Inventory overall remains lower than it was a year ago even with renewed home seller interest. And as for the struggling homeowners, as they exit forbearance, the government has implemented measures to help them avoid foreclosure.

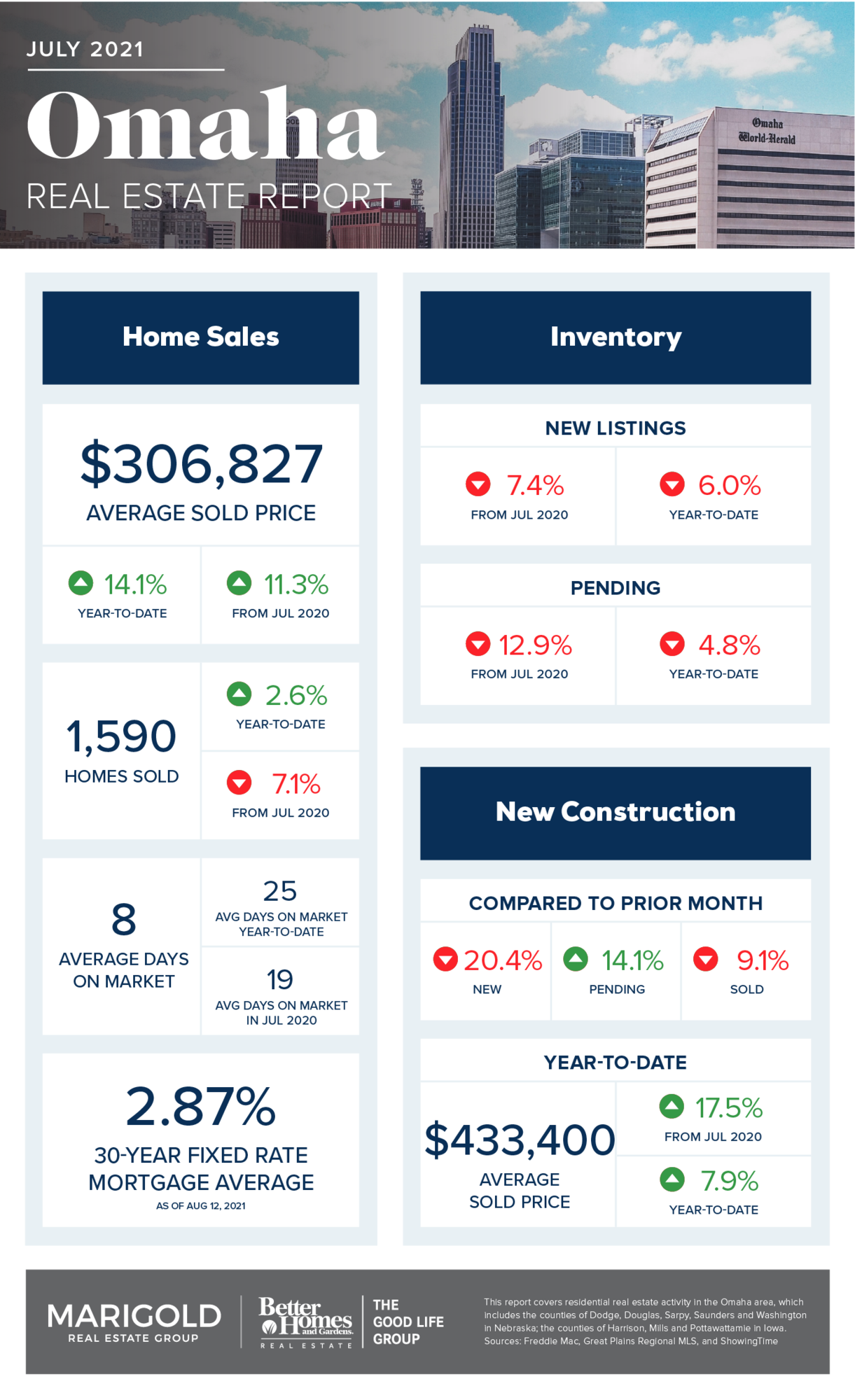

Let's take a look at some of the numbers from the July 2021 data released by the Great Plains Regional MLS:

July 2021 Omaha Area Real Estate Statistics

Average Sold Price: $306,827 (Up 11.3% from July 2020)

Homes Sold: 1,590 (Down 7.1% from July 2020)

New Listings: 1,767 (Down 7.4% from July 2020)

Pending Listings: 1,358 (Down 12.9% from July 2020)

Days on the Market: 8 Days (Down 57.9% from July 2020)

All data from Great Plains Regional MLS. Report © 2021 ShowingTime.

This report covers residential real estate activity in the Omaha area, which includes the counties of Dodge, Douglas, Sarpy, Saunders and Washington in Nebraska; the counties of Harrison, Mills and Pottawattamie in Iowa. Sources: Freddie Mac, Great Plains Regional MLS, and ShowingTime