If you thought higher interest rates would slow down the real estate market, you were wrong.

At the end of 2022, the market in the Omaha area did slow down quite a bit.

But, things have picked back up.

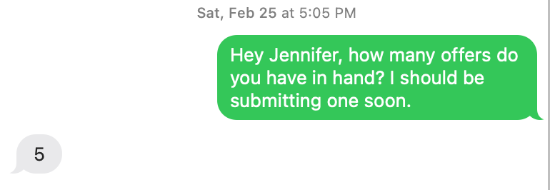

Here's a text from two weeks ago.

I’ve written a dozen offers in the past month. Every home except one had multiple offers.

In a couple of those cases, there were over 10 offers.

Homes are going over asking price - by a lot.

If you are thinking of buying a home in this market, make sure you do these three things:

- Get pre-approved, you need to know how much you can afford. Plus, your offer won’t get accepted without pre-approval.

- Save money! The more money you can put down on a home, the more competitive your offer will be.

- Don’t